Did Brooklyn ever really have a chance at winning the new Amazon campus?

The Brooklyn Tech Triangle may have many assets, including residential space, creative companies, food, and educational institutions, but a comparison of the bids presented to the Seattle-based behemoth looking to house at least 25,000 workers shows that Long Island City, the company’s choice, had some distinct advantages.

Not only did Long Island City offer space above a subway station for the first tranche of workers, that building, at One Court Square, was closer to a move-in than two sites proposed in Brooklyn: the Panorama complex (formerly the Watchtower headquarters) at the edge of Dumbo and Fulton Ferry, and Dock 72 at the Brooklyn Navy Yard.

One Court Square was presented as cheaper than Panoroma and competitive with Dock 72. Also, future office space—Amazon seeks a total of 4 million sq. ft.—would cost less in Long Island City, with more opportunity for contiguous sites.

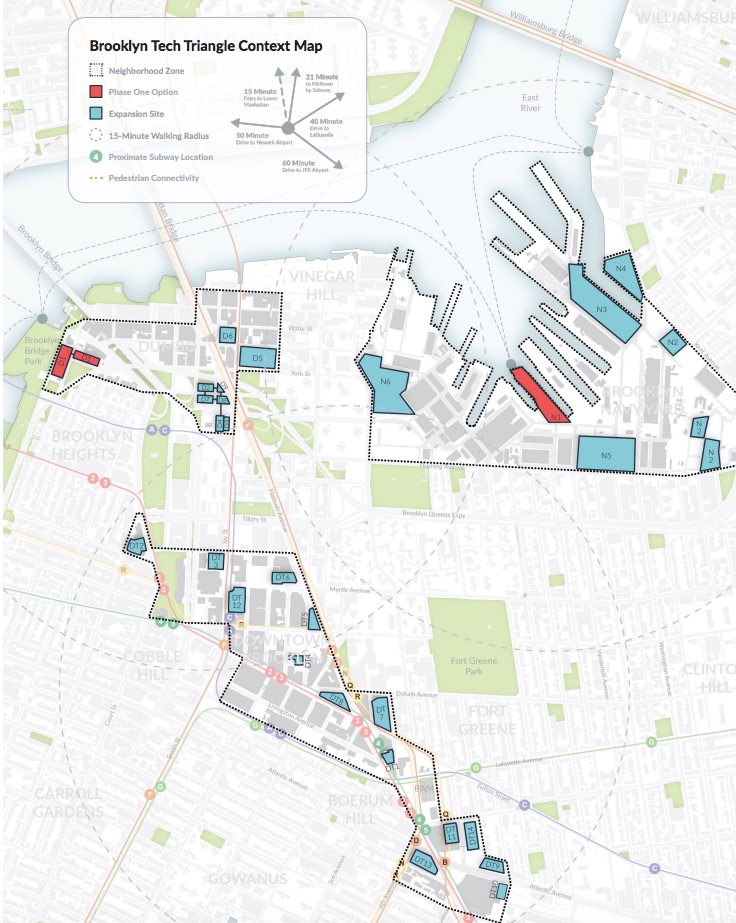

The city/state bid included a map showing sites available in the Brooklyn Tech Triangle, including Downtown, Dumbo, and the Brooklyn Navy Yard, with the Phase 1 buildings in red (Map courtesy of the NYC EDC)

Still, boosters of the Brooklyn bid pulled out the stops, even mocking up an image with Amazon supplanting the former Watchtower sign on the complex formerly owned by the Jehovah’s Witnesses, and in the process of conversion by its new owners, Columbia Heights Associates.

The city-and-state bid to Amazon, released last night by the New York City Economic Development Corp. (NYC EDC) after a public information request from Politico, even modified Milton Glaser’s iconic “I ❤️ New York” logo by substituting Amazon’s smiling-arrow symbol for the heart image. The documents emerged less than two days before the first City Council hearing regarding plans for a new Amazon campus.

Brooklyn < LIC

While Brooklyn offered a cost advantage over both Midtown West and Lower Manhattan, the other two city neighborhoods in the package, Long Island City still offered logistical and price advantages. For example, One Court Square, long known for its anchor tenant Citigroup, was said to offer “net illustrative rent” of $46 per sq. ft.*

Amazon would get 12 months of free rent on a 20-year lease and, yes, NYC EDC also presented an image of that building topped by the Amazon logo.

In Brooklyn, Dock 72 at the Navy Yard, under construction by Boston Properties/Rudin and scheduled for occupancy next year, was presented as renting for $43 per sq. ft. But that 610,000-sq.-ft.space, despite offering an outdoor half basketball court and four outdoor terraces, is far from a subway, relying on shuttles and a future ferry. It too offered 12 months of free rent.

The Dumbo-adjacent Panorama site, 25-30 Columbia Heights, is under conversion and “offers a prominent signage opportunity atop a Brooklyn icon,” but also lacks direct subway access. The rent was said to be $59 per sq. ft., with six months free on a 20-year lease for the 772,000-sq.-ft. complex.

Real-state firms that proposed buildings for the first phase of occupancy were said to have executed term sheets with NYC EDC, thus agreeing to refrain from leasing their space until this year in order to hold it open for a prospective Amazon move-in.

Building out the Campus

Beyond that, for the further buildout, several Long Island City sites—including some (but not all) that Amazon chose—were presented as costing between $24 and $49 per sq. ft., a relatively wide range.

Brooklyn didn’t quite measure up. While five potential expansion sites at the Brooklyn Navy Yard were said to cost $43 per sq. ft., the total available space (2.6 million square feet) would have been insufficient for Amazon, even combined with Dock 72.

Ditto for the eight potential expansion sites in Dumbo, offering 2.54 million sq. ft. and renting for at least $54 per sq. ft. (Note: before Amazon decided to split its purported HQ2 into two sites, including Crystal City, Va., the sites contesting for HQ2 were presenting a potential 8 million sq. ft.)

The bid touted the recently expanded NYC Ferry, while promoting the Brooklyn-Queens Connector (BQX) as “a state-of-the-art streetcar with the potential to connect over 400,000 residents to major job hubs along the Brooklyn and Queens waterfronts”—but, of course, its future remains uncertain.

“Land Use Action Required”

Brooklyn’s bids offered many creative proposals for using space under development, or planned for it. The eagerness to welcome Amazon meant that a good number of site owners were open to a change in use and thus zoning, typically a deliberative process involving community input and City Council approval, but not in this case. After all, Empire State Development, Gov. Cuomo’s economic-development authority, has been prepared to override city zoning to ease the process, as it plans to do in Queens.

In Dumbo, more than 1 million sq. ft. would have come from converting the 85 Jay complex, a former Jehovah’s Witnesses parking lot expected to house residential space, into office use, albeit renting for $64 per sq. ft. The document notes “land use action required,” indicating the need for that state override.

The city, which pitched four sites in Manhattan, Brooklyn and Queens, included this rendering of Amazon’s logo atop One Court Square in Long Island City (Rendering courtesy of the NYC EDC)

Downtown Brooklyn, offering much transit and adjacent residential space, offered more than 9 million sq. ft. in 14 buildings, with rents said to be between $49 and $59 per sq. ft. Notably, the bid indicated a willingness to ensure that two planned buildings, 565 Fulton St. and 625 Fulton St., would include office space, with “land use action required.”

Moreover, the bid discloses an ambitious plan for construction at, and near, the Pacific Park project, all associated with the address 590 Atlantic Ave.. That’s currently home to retail outlets P.C. Richard & Son and Modell’s, at the intersection of Flatbush and Fourth avenues.

The four prospective towers offered to Amazon included one site at the northeast flank of Barclays Center, long known as B4 of Atlantic Yards/Pacific Park, which is expected to start construction next year and house 810 apartments. It too would have required “land use action.”

Another would be the 1.14 million-sq.-ft. tower (or towers) planned for the P.C. Richard/Modell’s parcel, long known as Site 5 of the Atlantic Terminal Urban Renewal Area. While that site has been approved for office space, the developers aim to augment it by shifting the bulk of the never-built tower approved for the Barclays Center plaza across the street, which also would require “land use action.”

Finally, the bid discloses ambitious plans to build towers, apparently already permitted by current zoning, over the Atlantic Center mall. The bid describes two sites, one with 990,000 sq. ft. and the other, with 1.84 million sq. ft. (which likely means two towers). Such towers were once to be designed by Frank Gehry, the original Atlantic Yards architect.

While Brooklyn’s business and civic leaders appeared to put a lot of effort and creativity into the bid, and Brooklyn’s tech community touted its abundance of talent, the Long Island City bid tended to offer cheaper and more readily available space for the early and later phases of the project. But in the end, given Brooklyn’s current issues with high costs and gentrification, the prospect of having Amazon at arm’s length may offer more tempered benefits and challenges.

*(That calculation means effective rent after as-of-right incentives on a per rentable square foot basis in 2017 dollars, assuming 170 gross square feet per employee.)