How Brooklyn Companies Plan to Spend Their New Tax Breaks

More hiring, increased charitable giving and even bonuses for the rank-and-file are among the responses to the law change

Master Chocolatier Anwar Khoder at Li-Lac Chocolates in Sunset Park, where the owners plan to use their tax savings to expand the business more rapidly (Photo courtesy of Li-Lac Chocolates)

For Chris Taylor, a co-owner of Li-Lac Chocolates, the new tax law will be like a tail wind, giving his business a sudden push forward. Li-Lac, which makes its chocolate in Sunset Park and operates five stores in the city, could particularly benefit from a provision in the law enabling companies to write off their investments quickly. “In the past, we would have to pay a few hundred thousand [dollars] to build a new store and we would have to pay a few hundred thousand to the government,” says Taylor. “But now, when we spend more money to build a new store, we pay less to the government. This will make it possible for us to grow much faster.”

While the Tax Cuts and Jobs Act signed by President Trump on Dec. 22 provoked confusion and protest in many places, particularly blue states like New York, the corporate breaks in the law provide sudden opportunities as well. The law contains several provisions favorable to businesses, including a cut in the corporate income-tax rate to 21%, down from 35%; the ability to write off qualified investments in new facilities right away, rather than over several years; and the potential for a 20% income deduction for small-business owners who own companies via pass-through entities.

“We expect to see many of Brooklyn’s small businesses benefit,” says Andrew Hoan, president and CEO of the Brooklyn Chamber of Commerce. “Whenever you can take money and reinvest in your business with updated equipment, new hires or more employee incentives, it’s a win for Brooklyn’s workforce and greater economic development.”

Los Sures is a Brooklyn nonprofit supported by Dime Community Bank, which plans to increase its charitable giving (Photo courtesy of Southside United Los Sures/Flickr)

Medium-size companies with hundreds of employees will benefit as well. “If you think about a middle-market type of company, these favorable provisions can impact purchase of machines, furniture, computers, software and anything else that you might use in a business,” said Joel Boff, an accountant at CohnReznick, a Manhattan-based accounting firm with many Brooklyn-based clients. “The whole purpose of that is to make it easier for businesses to get the resources they need to make their product and sell their product–and to be successful.”

While companies could simply ramp up profits in some cases, business leaders who spoke to The Bridge seemed determined to invest in longer-term growth and give back to the community. Dime Community Bank, which is headquartered in Brooklyn and has 400 employees, put out a statement to that effect within days of the bill’s signing. The bank’s response to the tax law, Dime said, has “one overriding principal: get the tax savings back into the economy.”

Dime said it plans to accelerate its hiring of workers in areas like cybersecurity, to give a one-time $1,000 bonus to non-executive employees, to start a corporate matching-gift program, and to double its charitable giving. The bank will also consider a dividend boost for shareholders, but it pointedly won’t be giving any windfall bonuses to executives.

Kenneth Mahon, CEO of Dime Community Bancshares (DCOM), the bank’s parent company, told The Bridge he’s enthused about the opportunity to increase the bank’s local philanthropy, mentioning two groups Dime has long supported. “I sit on two non-profit boards in Brooklyn. One is Los Sures, a Latino organization that does a lot of housing work in the Williamsburg community. And the other is Brooklyn Legal Services, that provides services to less-wealthy people,” says Mahon. But he hopes the tax savings will benefit other groups as well. “There a lot of organizations that our employees have worked with throughout our branches, and a lot of those organizations and businesses already have accounts with Dime. This is a good chance for us to give back to them for being customers of ours and to support their organization.”

Steve Hindy, co-founder of Brooklyn Brewery, says the new tax law will enable the company to do more hiring (Photo by Natan Dvir/Polaris Images)

For Taylor, whose chocolate factory is in Industry City, the quick investment write-off is the biggest single benefit of the new law. “What the 100% deductibility does, is that it protects our cash flow when we’re growing rapidly,” says Taylor. “We’re going to open up more stores. We’re opening up a new store in Hudson Yards and we’re looking for another location. And before the tax law, we could probably only do one at a time and now we’ll probably end up doing two.”

Hiring will go along with Li-Lac’s expansion. “Hiring people is an investment. At year end, we say, Okay, here’s how much cash flow we have and here’s what we need to pay in taxes. And whatever we have left over is what we use to buy machinery, hire new people, or open up a new facility. So now we’ll also have more money to invest in people, whether that’s paying existing people more or hiring new people.” The company currently has about 50 employees.

Besides its general corporate breaks, the tax law contains provisions that will benefit specific industries as well. One of them, the Craft Beverage Modernization and Tax Reform Act, is expected to bring more than $140 million in annual savings to America’s small brewers, distillers and wineries. The benefits will be felt in Brooklyn, which has a booming craft-beverage industry including about 20 brewers.

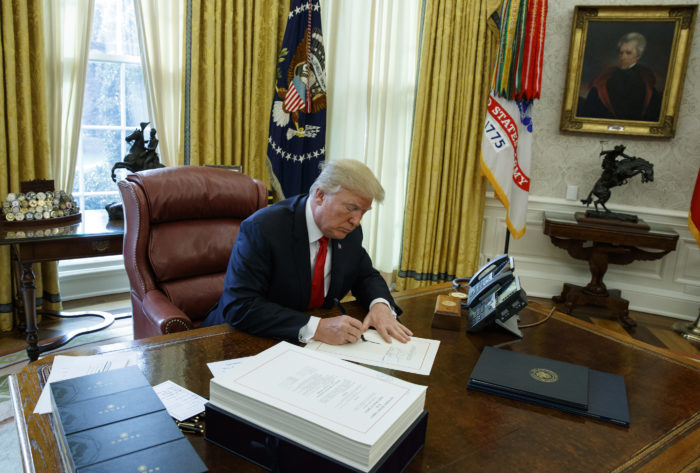

President Trump signing the new tax bill in the Oval Office on Dec. 22 (Photo by Evan Vucci/AP)

The industry had been lobbying for the tax reform for nine years, according to Steve Hindy, co-founder of Brooklyn Brewery, the borough’s largest craft-brewing company. “Back in 2008, we saw what the Obama Administration spent on the stimulus package to create jobs and it was around $50,000 for every job that was created. So we were thinking, Wow, well, we’re creating jobs every year, craft breweries are. And if we could get a break in our excise tax, we could create a lot more jobs. The excise tax is the one that brewers pay on the beer they produce. It was actually imposed during the Civil War to finance it back in the 1860s and it’s never really been reduced over all those years.”

The tale is an instructive look behind the scenes of tax-law lobbying. When the small brewers proposed their break, the major brewers opposed it, saying they should get a break too, recalls Hindy. “We said, ‘Well, we’re creating jobs and we’re expanding. You’re not necessarily doing that.’ Overall, the beer business is kind of stagnant. But then they created their own tax bill that would give them a tax break, as well as small breweries. So we kind of fought head-to-head for a few years and then about two years ago, the Senator from Oregon, Ron Wyden, developed this Craft Beverage Modernization and Tax Reform Act.”

The new bill included breaks not only for brewers big and small, but extended them to wineries and distilleries as well. “Suddenly you had the whole alcohol-beverage industry working to get approval of this in Congress,” says Hindy. Even so, “we were surprised that they included the craft- beverage bill in the big tax bill.”

Brooklyn Brewery, for its part, plans to pour the savings back into the business. “The money that we save this year will go into our capital program. We’re expanding our operations in New York State and we’ve also bought minority interest in a brewery in California and one in Colorado,” says Hindy. “Both of those are going to be expanding significantly. And you know, all of the 6,000 breweries in the U.S. will benefit from this bill and the small craft breweries will be reinvesting that money. I don’t know anyone that will be buying a new car or going on vacation. It’ll go to expanding the breweries, buying more and better equipment and hiring new people. We’ll be adding 10 to 20 people in the coming year.” The brewery currently has 150 full-time employees and 90 part-timers.

Despite all the straightforward aspects of the new law, the impact of some parts are still unclear, notably in high-tax states like New York, where taxpayers would be hit by the reduction in deductibility of state and local taxes. Said the Chamber of Commerce head Hoan: “We are awaiting the details of the proposal by the governor and state legislature as they work towards restructuring our tax code to adapt to the loss of [that] deduction. How this impacts Brooklyn and the New York State economy remains to be seen.”